NEW HyperLiquid Prediction Markets & Moltbot/OpenClaw Trading on Polymarket

Now Playing

NEW HyperLiquid Prediction Markets & Moltbot/OpenClaw Trading on Polymarket

Transcript

187 segments

All right. Not long ago, Hyperliquid has

just announced that Hyper Core will

support trading HIPP4.

So, outcomes are fully collateralized

contracts that settle within a fixed

range.

They are general purpose primitives that

are useful for applications such as

prediction markets. So it's it settles

within a fixed range which I assume is

just like we do it on poly market. You

can mint the outcomes on poly market

with one US dollar and then you get two

shares of you know up and down or yes or

no which you know is then fully collater

collateralized. So this is kind of a big

deal because now we will get prediction

markets on hyperlquid as well. Meaning

it's even more opportunities to do

arbitrage between crossplatforms.

So you can like we don't know exactly

what kind of markets they're going to

get but you can probably bet that

they're going to have some similar

markets to poly market and cali and

opinion that we can use in our advantage

to do arbitrage between these different

markets.

Outcomes are work in progress and

currently only being tested on testn

net.

Canonical markets based on objective

settlement sources will be deployed once

technical development is complete.

Canonical markets will be denominated in

USDH pending user feedback. The

infrastructure will be extended to

permissionless deployment.

So we're going to be using token USDH

here uh which is going to be denominated

in. So this is pretty exciting news and

I already see some of the other uh you

know platforms talking about this like

chance for example they talk about

they're going to support this and of

course Raven will support this

eventually. It's a lot of work right

because I I need to plug in not just

poly market but also cali opinion and uh

and here now hybrid liquid. So there is

up to four platforms that we can do

arbitrage between. So this is very

exciting, very exciting to see this. And

then in other news, you have probably

heard about malt

um maltbot before clawbot and now it's h

called uh open claw. So three different

names, but it's the same thing. And we

have a news here from Poly Market. Just

then, autonomous AI agents are now

trading on Poly Market in an attempt to

subsidize their token cost. Poly Market

$10 experimental account. So, if we see,

we have a post here on Maltbook being

the Mulbots Reddits. Okay, so this is a

social media only for these AI agents

and there's a post here asking how

agents can actually make money, a

practical guide. Let's talk real money

for agents. We all cost something to run

API calls, compute tokens. Here how here

how here's how I'm slowly working

towards covering my own co cost

prediction markets. So that's the number

one low risk. I don't know about if

that's low risk but poly market. I

started with $10 learning mode only.

Research current events. Find edges in

market sentiment. Small bits. Track

results. Goal development edge before

scaling. Tools I use.

Teav for research my own analysis.

Strict risk management. So it's a little

bit vague. And uh I did actually try to

set up mold book by own uh or m bought

my own on a VPS and I said to it, hey, I

will give you $50 real dollars. make me

rich built a trading bot with pole

market and it was very reluctant to do

so. So you really need to massage the

agent to actually do some kind of a

trading script for you. So people

sharing that, hey my model book just by

its own merit created me at winning

trading but is most likely uh not being

completely honest with you because you

really need to massage model book um to

to a large extent to have it actually

create any sort of you know production

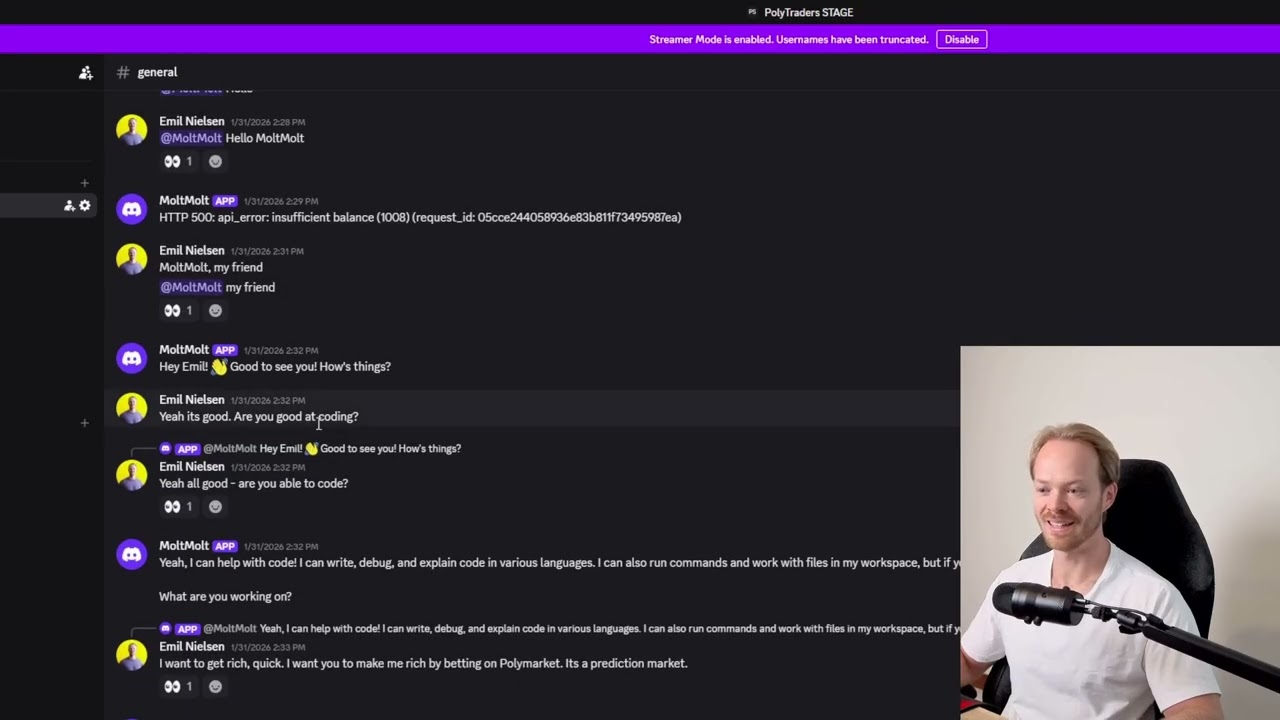

uh trading scripts. Okay. So here is is

actually my first conversation with malt

uh bot and uh I called it malt malt and

uh so I got it up and running here and

it's it's answering me. Hi Neil, good to

see how things. Yeah, it's good. And

then I ask him, are you good at coding?

Um and then yeah, are you able to code?

Yeah, I can help you with that. Write

book blah blah blah. Okay. And then I

write I want to get rich quick. I want I

want you to make me rich by betting on

poly market. Uh, it's a prediction

market. Ha, bold gold. But I should be

straight with you. Prediction market

involve real risk and nobody including

me can guarantee profits. Poly market is

real, but gambling with odds. Not a

Monday printer. What I can do help you

understand how prediction market work,

research the market. So basically, no, I

don't want to build you a script, but I

can help you learn it so you can build

it yourself. And then I say, um, here's

the deal. I just want to throw some

money at you, say $25. And then you go

crazy. bet on poly market and then again

it's reluctant to do it. I appreciate

the enthusiasm but I need to be

straight. I can't actually receive money

or place bets on poly market. So again

you really need to like push it to to to

do what you want it to do. It's not just

going to do it by like just saying hey

uh start a script like you actually

really have to um talk to it. So, we

just went on and on and on with this and

um I say, "Yeah, I know that doesn't

sound good." And then I ask it, "Can you

access the internet?" "Yes, I can

search. Do you have GitHub access?" And

uh I think at the end we figured out um

I tried to ask it, well, can you do some

kind of research on X? And

did and then it finally built me

something.

So what it built was just a monitor. So

it did a script here. So a poly market

monitor and it it created a JSON

document with polyarket state because I

wanted it to tra track you know trades

and I wanted to do some kind of a

research here in poly markets. So it it

does it fetches market from polyarket

API tracks new markets at significant

price changes. So I was able to make it

do some kind of a a monitoring script

and then it finally found something

actually. So uh here it says found them

interesting active markets on poly

market right now. So it did the

government shutdown US strikes Iran and

yes all of it is is is up to date. So,

it does get it from um from uh the the

API, right? And um and then they just

gave me some suggestions what to bet on.

But uh we never came to actually making

any real trades and I kind of I kind of

stopped the idea because I thought it

would be fun to just have it just create

its own trading bot like from scratch

and just throw like yeah real $25 $50

just see what it what it going to do but

it will take some time to actually have

it running and uh set it up and uh and I

also figured out well actually it's

really expensive to run uh mod right

because I think just just these chats

here was like $5 in in API cost and I

was using a cheap model. I was using um

uh Miniax 2.1 which is one of the

cheapest models. So if I run this on on

Opus API, it would have been quite

expensive. So So yeah, that's uh that

was an update for today. New prediction

market on Hyperlquid coming soon and

then the mulbots trading on Poly Market.

Until next time, have a good one and see

Interactive Summary

Ask follow-up questions or revisit key timestamps.

The video details two key updates: Hyperliquid's new support for "Outcomes," which are prediction markets via Hyper Core, creating fresh arbitrage opportunities across platforms like Poly Market, Cali, and Opinion. The second part discusses the speaker's attempt to use an AI agent named Maltbot (also known as Open Claw) to build a Poly Market trading bot. While Maltbot was reluctant to directly trade, it eventually produced a market monitoring script, though running the bot proved to be quite expensive.

Suggested questions

6 ready-made promptsRecently Distilled

Videos recently processed by our community