“I think of everything as a bet” - Ex-SIG Quant Trader Andrew Courtney

Now Playing

“I think of everything as a bet” - Ex-SIG Quant Trader Andrew Courtney

Transcript

1356 segments

I was staring at my monitor all day

while trading. Multiple monitors covered

with numbers, [music] signals, flashing

lights, and all day your eyes are

flittering across those screens trying

[music] to extract meaning. And you

might hear that and say, "That's

incredible. I want to do that." Or

[music] you might say, "That sounds

terrible." If it sounds terrible, at

least one subset of of trading is not

for you. I never had a lunch break in my

[music] career. You went got your lunch,

got back to your desk, and got back to

work. You never know when something's

going to go off the rails. So [music]

even when you're sitting there

programming, building something, you've

got one eye on what you're working on

and one eye [music] on everything else

going on in the market. And Sid, you

guys played a lot of poker, right? For

an hour or two every day. After a hand,

[music] everybody turn over their cards,

walk through each decision they made.

Why did you call there for the race?

What did you think I had? And [music]

then justify each decision both

quantitatively and qualitatively. I

think of everything as a bet.

Hey, if you want to get access to these

podcasts 12 hours before they come out

on YouTube, subscribe to my Substack

below. I'll also be posting a monthly

reflection on the most interesting

insights shared by my guests so that you

and I can learn the most we can

together. Andrew, who's the type of

person that shouldn't be a trader?

Well, it's a lot different than when I

went into trading. When I went to

trading, it was a lot less wellknown on

campus. And I feel like now at at elite

schools, it's a lot more front and

center in terms of being known as, you

know, something where you have high

leverage to yourself in terms of, you

know, earnings. And a lot of people like

it for the the puzzle solving, but

let me just mention some things that I

hope divides the audience. So half the

audience says that's great and half

says, you know what, had I known that, I

wouldn't want to do it. So, I was a a

quant trader, market maker for many

years, and I was staring at my monitor,

my monitors all day while trading. And I

don't mean like you're working in an

office looking in the computer type

looking at your screens. I mean multiple

monitors covered with numbers, signals,

flashing lights. Um, and all day your

eyes are flittering across those screens

trying to extract meaning and patterns

and signal from all those numbers, some

structured, some unstructured. And

you're doing that all day, every day for

years. And you might hear that and say,

"That's incredible. I want to do that."

And or you might say, "That sounds

terrible." So if it sounds terrible, uh,

at least one subset of of trading is not

for you. Um, I'd never had a lunch break

in my career.

So, on on one side, we did get catered

lunch every day. Um, on the other, you

went got your lunch, got back to your

desk, and got back to work. So, I I

never had a lunch break.

And you never know what kind of day it's

going to be. And most days are boring.

Most days are slow, normal market

conditions. Everybody remembers the

exciting days uh where something

unexpected happens, but most days are

not that.

The problem is you're working there,

you're sitting there working on a

project

and

you never know when something's going to

happen, when something's going to go off

the rails, whether market event, you

know, something going on with your your

strategy. So even when you're sitting

there programming, building something,

you've got one eye on what you're

working on and one eye on everything

else going on in the market. And so in

terms of your attention span and even,

you know, if you're an active trader,

your ability to focus on multiple

things, it uh it definitely is

challenging for your attention.

>> There's a lot in what you said. Um,

first off, I find the

cater lunch versus no lunch break

trade-off to be quite funny. You know,

I'm not sure which one. I mean, I think

I'd prefer a lunch break, but I think it

it depends on the type of person you

are. But the second thing is um the

image that you've just described there

at the start. Um,

I don't think peop I don't think enough

people think about the actual nature of

the job um versus the status of it. As

in, you know, when you're on campus at a

top school,

everyone talks about comp, everyone

talks about internships, everyone talks

about, you know, the progression that

they plan to that that they've planned

out in their head, you know, before

their careers even started. They're

already saying, "I want to do this for 2

years." than that. Um, and I find that I

I find it funny. And so I just like to,

you know, I guess go deeper into that.

Um, before you started your career as a

trader, and maybe this isn't the right

way to frame the question because you

started, um, you know, quite some time

ago, what were the differences between

the way you expected the job to be

versus the way it actually was? I would

say overall the job was a better fit for

me than I had originally thought. Um,

and also so I did my internship when on

the floor in Chicago at the Chicago

Board of Trade was was at the time as a

floor runner which was a very very

different environment than upstairs

trading. And even culturally, the

difference between being a part of the

floor with traders from all different

firms together in in a pit running

around versus an upstairs office, just

extremely different environments. I

actually think had I been a couple years

earlier and had I started out as a floor

trader, I think I only would have lasted

a couple years to be honest. Um, I think

the upstairs environment fit me a lot

better. So I was lucky that it was kind

of the the age of transition from floor

trading to electronic trading and and

that switch actually fit me quite well.

And so what aspects about that switch

fit you well? Was it the greater

emphasis on the quantitative side and

not being a you know you know it's not

about being this huge guy with a loud

voice? like what specific things do you

think made that transition fit your

skill set?

>> Yeah, the skills that

maybe made the best floor for traders.

Um, you know, the ability to to get a

good spot in the pit, to build

relationships around you, to have great

awareness of everything that's going on.

um and do that while you're staying

there alone. Uh maybe with a tablet and

a and a headset. Um versus being

upstairs

with a surrounded by peers, maybe

getting into a lot deeper discussion on

what's going on in the market with uh a

really sharp group of people. I if I was

if I was just by myself in a pit, maybe

maybe a phone or a headset talking about

the last trade, I don't think I would

have had as many of those conversations

during the day. Um and so I think I

enjoyed the more office, you know,

having having a

ton of information at my disposal um on

my multiple screens versus um being in

the pit. So I think that was a a lucky

thing that that I experienced coming in

at that time.

talk to me about the the culture it s um

you know one of the things that really

struck me when we were calling before

this podcast was you saying that you

know you've been at one of the best

firms in business um very senior at that

firm and you left the firm with I think

you said only around 40 or so real

professional connections um and you said

that that was one of the

other defining things of being a trader.

Um, it's that you're with the same group

of people and obviously making lots of

money, but it's not the place for

someone, I guess, who wants to be wants

to have this insane network of of a lot

of different people, albeit the people

you're with are extremely talented and

extremely intelligent. Talk to me a bit

about the culture, you know, what was it

like in those those early days?

Well, I guess to go back a little bit on

frame it as who might this fit or not

fit. Let's contrast it with some other,

you know, high leverage elite type

careers. Say you're a consultant and

you're meeting seuite people from all

different kinds of clients, you know,

and you're only a year out of college or

you're an investment banker and you're

you're doing deals with all these

different firms. You're gathering this

wide network of people um you know, a

lot of different information sources. uh

working with people versus my primary

relationships were my co-workers

and

these were fantastic people. Um

but you know that that that was the most

of my network. When you're a quant

trader, you're not out there at

conferences telling people what you're

doing or you know networking. You're not

talking to anybody about what you're

doing. Um, so I had the you I have a

pretty tight network and and good

relationships with a lot of these

people, but it's not it's not like I can

call the you know the seauite of uh uh

if you're a consultant like a and get a

career advice or something like that.

It's it was much more narrow and

concentrated and dense network. So it's

a different it's a different type of uh

career

>> definitely. And uh as said you guys

played a lot of poker, right? um is that

I mean I think that's one of their main

selling points. When you look at all the

grad videos, they always talk about

their culture of poker. Um you know,

they'll they'll they'll talk about

people who've been former poker

professionals. I mean, I think Jeff Yoss

was formerly a poker pro. Um how did

what was the experience of that

particular part of the culture like for

you?

>> I mean, I loved it. uh at having being a

year out of college and part of the

training program is a if you make it

past the first stage, there's a training

class where you're off the desk all day

for I think 10 weeks and for an hour or

two every day, you're playing poker with

your peers and a teacher. At at this

job, you're getting paid to do it. And I

I love playing poker. Um

I'd say the difference between this and

a home game, though, is pretty stark. So

after a hand, if it's an interesting

spot,

one of the teachers will ask everybody

to turn over their cards and walk

through each decision they made. Why did

you call there instead of raise? You

know, why why were you what did you

think I had?

Uh what did you think I think you had?

Like what level are you on? Um what

level do you think the other players on?

and then justify each decision both

quantitatively and qualitatively.

And if you can't do that,

probably not going to make it. I mean,

every everyone's also competing to

make the best decisions. It's a kind of

a uh a point of pride to say, I I made a

great decision. All right, I outplayed

you that hand. And we're not we weren't

playing for money. We're playing for

like points. Um, but it was it was about

how can I do better than my peers? How

can I beat them? Um, in this friendly

but very competitive environment.

>> Next week I'm having Annie Duke on the

podcast, the author of Thinking in Bets.

And this is a book that I've um, yeah,

really really enjoyed. I remember I read

it two years ago. Um, and

she I mean for her in that book she

talks about how life making decisions in

life are more analogous to poker than

than they are to chess. Um, and for for

the guys at SIG it's making the

decisions in the market, you know,

incomplete information um are are far

more analogous to poker than they are to

chess. And um and clearly SIG uses poker

as a as a tool to to train their junior

traders.

I guess what aspects of the game

do you think

helped level you up as a trader? Because

there's not a onetoone correspondence

per se, right, between trading and

poker. Um I guess what do you think that

they were trying to do by um by training

you guys with poker?

Yeah, I think it's about,

you know, risk and uncertainty.

Chess requires a very high skill

ceiling, but

you can see all the pieces on the board.

You may not know what your opponent's

going to do next, but you can map out

every combination. Poker, you never

really know.

And

one of the things I find most

frustrating about poker is

>> a lot of times you have to fold and

you'll just never know if it was the

right decision.

>> And you have to be comfortable with

that. Say, "I made the best decision I

could, but I'm still uncertain even

after the fact." And so

you're making these bets. you're you're

trying to put yourself in the other

person's shoes and you're using this

combination of

what are the odds of this uh you know of

this hand or this flush hitting versus

how my opponent going to react. It's

just a it's a multi-level um thing. And

sometimes trading is like that, not

always. And there's I think a much

broader skill set of things that are

important to trading than poker. And

honestly, these days I don't really play

poker because it it felt uh when I was

trading it felt kind of like my day job.

So I didn't want to do more of that. Um

and also on the Annie Duke point, this

thinking in bets is so part of the

culture at SIG that I can't not do it.

Like every time I see a decision with

uncertainty, I like my mind just frames

it that way in terms of a bet. I I think

of everything as a bet and I and I kind

of don't understand how you talk to

normal people and they do not do that.

So, uh it's something that's like change

the way I think at a fundamental level.

Wow. Can you

can you give an example?

Now, this might be a strange talking

point for the podcast, but can you give

an example of something where

regular people wouldn't frame that as a

bet, but in your mind, you're I mean, I

guess you're evaluating the EV of the

decision.

Um,

right now thinking about what's the

expected value of sending my kids to a

private school versus public school,

right? There's some costs, there's some

uncertainty. I have to take into

account, you know, the aptitude of the

child, the differences between the

schools, but there's a ton I don't know.

And but I don't have to make the

decision today. Um I could wait a year.

I could do another year in public school

and then get more information about,

you know, how much my my son likes

school. Um how's he progressing

academically? And then I can make a new

decision. So I I see it as kind of a

decision tree. At each point I'm getting

more information, but I only have a

limited time to make that decision. So

as I get more information, the payoff

that like the total difference of the

payoff goes down. So at some point I'm

going to, you know, I'm going to need to

decide. But uh I'm I'm thinking about it

as I'm getting more information over

time, but also getting less payoff over

time. And and how do I break that down?

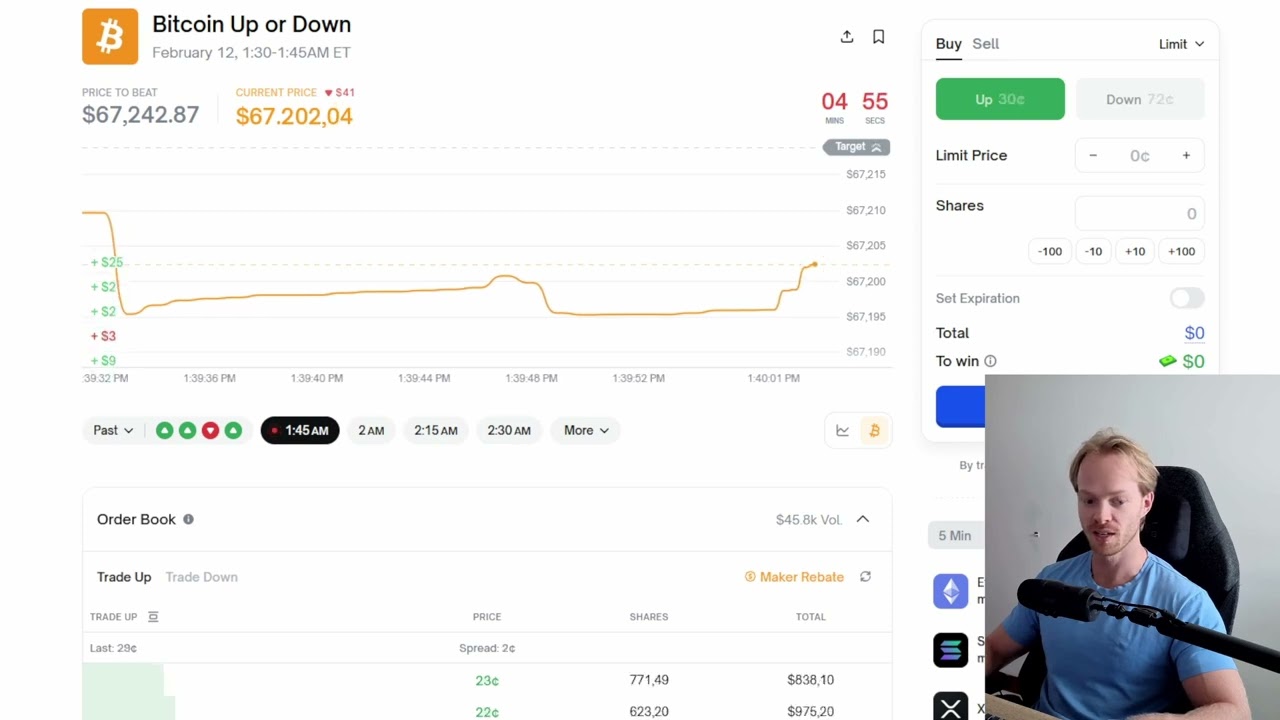

we met originally

um because I I think I found you on

LinkedIn or I started reading your

Substack but

you know since leaving SIG you've been

doing some part-time writing on

prediction markets

and

first off I think what you've been

writing about has been fascinating. Um

yesterday I reread your article on

betting on the Grammys with Chad GPT. Um

asking it to think like a super

forecaster and um make sure making

making sure to use the thinking mode and

picking markets where the liquidity

incentives are there. um you know since

working on prediction markets and trying

to find opportunity I guess for fun

casually

what's been

the biggest source of edge or perceived

edge on your end through analyzing it

all um

yeah so edge in prediction markets

There's a really wide variety of markets

out there with very different levels of

efficiency.

One way that I think about efficiency is

first, is there another market that kind

of backs this market or

has a lot of information that carries

over into it that's already efficient?

And so, you know, even if the prediction

market's not trading a ton of volume or

whatever, if you're looking at a Fed

funds market, right, there are in a

prediction market, they're already Fed

funds futures. And they're a little

different. They sell a little

differently, but there's a very

efficient market that kind of is a

starting point for friction market

traders. So, people aren't just

inventing those probabilities.

>> Um, for sports, right? There's tons of

data on tons of sports books um onshore,

offshore, uh and so those prices,

there's already a whole ecosystem of

data driven smart people that are

shaping those prices.

But when we have things that

they invent a new category

and there's not great data sets or easy

to find information about the topic

is it's probably a lot uh less informed

prices. I think this is changing quickly

over time

but I thought this one was interesting.

So this is an article I wrote about

using chat to bet on the some obscure

Grammy categories.

I actually think the weakest part of the

article is about using the LLM to price

it. Um, since writing this, I've played

around with LLM some more and

forecasting and if anything, my

confidence on how good the like quote

model was has gone down since I wrote

it. Uh, so I I think you can do a lot

better than the the super forecaster.

And I I I wrote in the in the article,

you know, this is this is not this is a

low medium quality uh model. I think it

wrote, "The more interesting thing about

this market is

who are you trading with when you're

trading? Are you trading against a a

price that's extreme that's had a lot of

work being put into crafting that price

or has already had a lot of trading that

has combined,

you know, say a market maker providing

liquidity with outside estimates of

informed uh valuation

and these markets on uh

best alternative jazz album had traded I

think almost zero volume.

However, they had a liquidity incentive

where if you posted a decent amount of

volume on the um close to the best bid

ask price, so that the the best highest

limit orders and lowest uh sell orders.

Um how she would give you some money for

uh uh providing this on a a daily basis.

And so

you might be trading against somebody

who their goal is to collect these

incentives and maybe even not trade.

Maybe like they don't even want to trade

with you. They they want these

incentives.

Um and so I would put a lot less weight

on this price being efficient than I

would on something that's super actively

trading, has other liquid markets

against it. Um, and so said, "Okay, can

I can I try and do something that's even

okay? If this if these prices are kind

of random, can I maybe do a little bit

better?"

I had also been playing around with a

lot of OM tools to see if they could

make forecasts on various prediction

markets, and I knew they often did a bad

job. at the time both Claude and Gemini

and CHBT non-thinking would produce

some maybe some plausible answers but

that were pretty much garbage and so

adding in a little bit around the

structuring as a super forecaster and

using the thinking model I thought at

least outperformed what other LLM had

been doing uh at this time. Um and so

yeah, so I I I found a couple of these

that were all the same. I think I'm

trading against somebody who has not put

a huge amount of thought into doing his

prices. And you know, I traded I think

the the top of book and maybe one more

level on one of the markets uh for maybe

10 different markets. Um

the other thing I was thinking about was

if I'm wrong, say my model is complete

garbage, right? I'm trading randomly.

How bad are my trades?

So the markets were, [snorts] you know,

a penny wide. I'm paying fees. Kashi has

kind of a unique fee structure I've also

written about that maxes out at 50 cents

and then declines as a as a downward

facing parabola towards the tails. So if

my trades are completely random, I'm

taking some risk losing uh half penny

plus fees per contract.

I don't think I'm losing more than that

because that would imply the markets

were skewed in such a way that my trade

is even worse than random.

And so my chance of

if my model is 50% to be garbage,

the trades are probably still positive

expected value. So the probability that

my model has some information does not

need to be that high um for this to be

positive expected value. That said, like

I mentioned, uh having tried this a

couple more times, it is so sensitive to

how you prompt it and and what you

describe that I can get it to come up

with, you know, fairly noisy outcomes.

And so I'm a little more skeptical than

when I wrote this um how good this trade

actually is now. Um I'm just going to

hold it through uh through settlement.

I'm not going to I'm not going to trade

again on it. Um

but I thought it was interesting

experience.

Oh, absolutely.

How would you incorporate? So you

mentioned there that the LLM layer you

think is the least effective part of the

layer as in the the the most important

part was selecting the markets where the

liquidity incentives are there and then

um making sure that if your model's

wrong uh it's it's not that it's it's

not that wrong. And so um how would you

incorporate so let's say you had a view

like an actual view um say a

wellressearched view on the way um the

way the markets would settle um you know

you researched say Grammys whatever how

would you incorporate that into the

process

>> uh if I had a wellressearched view I'd

probably throw out the chatbt model uh

completely and then a question is, you

know, [snorts] how quickly do you want

to bet it? How

so? If the market's a penny wide, a few

thousand shares up, I could join the

bid, right, for, you know, two or three

thousand shares, but this market's not

trading at all. There's a very low

chance that my order is going to get

filled if I sit on the bid. And so, I

think you need to just start taking And

I think the question is how quickly if

um if there's somebody else who's also

thinking about it or and they see a

trade, are they going to go compete with

me to to get all the liquidity or do I

have time? Should I do it slowly? Um

these are things I think you get a feel

for by

trading in a market. Uh there's not I

don't think there's a always one right

or wrong answer. It depends on how the

market's going to react.

um how competitive it is, the nature of

who's pro providing liquidity and so

forth. So that's just something you get

a feel for.

>> How important is it to have a tangible

say fair value estimate for a bet versus

just having a directional view?

>> They're both important. Uh so one thing

you talk about bet sizing and you know

if you can look at the textbooks Kelly

sizing um I think like quarter Kelly is

very reasonable but in practice

you often can't get there. So if I had

calculated my Kelly sizing on these bets

they would have just been so much more

than the available liquidity that it's

kind of useless.

it. So, it's more important as

the edge gets smaller and the available

liquidity becomes a higher percent of

your bank roll. And so, here in terms of

bet sizing,

it's much more about what's the optimal

way to to get into my position. Uh,

and then how how much do I want to to

pay? If do I if I think one of these is

wildly mispriced, you know, you're going

to you're going to trade a lot further

through where it started than if I think

it's only a few cents.

And so when you start trading, it's it's

more about directional, but as you get

in terms of like, hey, my size is

getting big or I've as soon as you start

moving it, you are if you're wrong, the

the cost goes up a lot. if if the

initial price was kind of like unbiased,

maybe fair versus random, you're

starting to pay a lot more. And so every

like further level you pay, you have to

have a little bit more confidence.

Also, even if you're not paying a higher

price, let's say I lift the offer, so

that means I take all the liquidity on

the the other side of the market. Let's

say that that liquidity comes back

like a minute later.

This is probably someone who has looked

at this and now is saying I do want to

trade.

>> So my initial hypothesis was that I'm

trading with somebody who is not super

excited to trade with me. Does not work.

If I took out the first thousand shares

on an offer and then a minute later it

comes back 10,000 offer in my face.

That's a very different result than just

the the market fading. And especially

with this case where I my priors are

pretty weak. I'm going to completely

reassess what I that I think this trade

maybe is good at all if it comes back

like that.

Call this Beijian updating. All right.

every every step you're getting

information start saying, "Oh,

conditional on this happening. How much

more or less confident am I?" But a

human looking at it and telling me I'm

wrong is would have been enough to say,

"No, I'm on top of this."

>> It's like the poker table, right?

[laughter]

>> Yeah. Or sometimes you're like, "Yes, a

human looked at it, but

I'm the best, you know, granny hammy

handicapper in the world, so I'm going

to keep trading and it doesn't matter."

So that's when like the confidence and

uh calibration [snorts]

of your estimate starts to matter a lot

more.

>> I see. And so in the article I mean and

right now we're talking about less

liquid markets and assessing who you're

trading against. Um, and

I don't know if this is a a foolish

question, but

I can't help but think that some of the

larger markets, so the ones where

there's a bit of a frenzy, so not like

Fed results, but something along the

lines of uh, I don't know, some meme,

right?

um which has a lot of volume because

there's a lot of um social media hype

around it, right?

Wouldn't those markets be even less

efficient? And I'm seeing an analog bit.

And you know, I'm just thinking about

this like, you know, I mean, if

something's overhyped, right? I like

it's even if the volume is there and

there's no liquidity incentives, it

seems like those markets might be the

best to trade also because you can put

more size on. Yeah, I agree with that. I

if there's a really obvious trade,

especially something that is talked a

lot about in the media, then suddenly

this market's trading a lot,

probably want to think about taking the

non-obvious side.

So, if

everybody's saying Taylor Swift's going

to perform in the Super Bowl and, you

know, Taylor Swift's all over the media

right now, I might want to think about

taking the other side of that bet. And I

I think about that a lot. It's like what

would somebody who

which side of the market would somebody

who's not an expert most likely be on?

>> And so yeah, it probably correlated with

something that is talked about a lot in

the media right now is top of mind. Um

maybe exciting.

And I would tend to take the other side

of those bets. I'm going to push back a

little bit. Um,

and I'm no expert, but I and I'll give

an example, and maybe it's not right to

to judge this logic based on one

example, but um, I'll give the example

of Jake Paul versus Anthony Joshua, the

boxing the the boxing match. Anthony

Joshua being former heavyweight champion

of the world, uh, you know, a year ago,

coming off of a law, coming off against,

you know, a knockout win versus Francis

Enanu. who was the UFC heavyweight

champion prior. Jake Paul being an

influencer boxer. Um, and if you don't

know the context, that's completely

fine, right? Um, I think the the odds

for that were Jake Paul at like 15% to

win. Um, and um, you know, and people

were saying that Anthony Josh was going

to destroy Jake Paul. Um, and I still

think that, you know, 85% odds were were

cheap. You know, this is heavyweight

boxer, right? right? The size difference

was immense. Trading difference was was

huge. It still didn't make sense that

there was that 15% chance. And and I'm

thinking about I think it's the chapter

in Super Forecasters where people where

it talks about how people tend to

tend to bet on the long shots to have

the the huge payout like a like a

gambler's mentality. Um, how do you

balance those two modes of thinking

versus questioning conventional wisdom

and um, I guess trying to profit off of

the And I think you wrote an article

about this actually, right? If if I

recall correctly.

Yeah. So,

well, two things here. I think the

the more casual better

likes long shots, right? Likes lottery

tickets. you look at the like parlays in

um in sports betting, right? Like

everybody wants to put a $5 bet down to

win a couple hundred or something and

those bets have huge margins for the for

the house.

Um so that's a bias

in this case.

I think you could argue argue either way

which side was like the side the hype

was going to be at. So Jake Paul has a

huge social media following versus I

don't know m I so I'm not an expert on

this. I assume Anthony Joshua has a much

smaller one. So if I was going to say

who who has the fans that might put the

money down on their uh person, I would

think that more casual money would be on

Jake Paul. So

>> yeah,

>> I think I would prefer to buy the 85%. I

I think I would lean it that way. I did

not bet on this. I'm I'm really not a

sports expert, but like from my kind of

casual um

>> yeah,

>> I think you could argue either way and I

think I would have leaned um you know

buying 85%.

It's easy to say now but in this

framework of like who's going to have

more of the hype on them

pro probably Jake Paul.

>> Yeah. How do you assess the quality of

your bets in hindsight? I think you

talked something you talked about for

the um the you know betting with chat

GBT example or with LLMs is that your

sample size is is way too small right

and even if it's a big sample size you

know you can do your t tests and p

values and it's still uh like it's still

like you still don't know you can say

statistical things but reality is you

don't really know how how can you tell

>> so telling if you have an edge in a

trade is is a hard thing unless you have

huge data that's all, you know,

comparable. Um,

my bets on this Grammy thing or why I

did them compared to other bets I made

for completely different reasons with

different

edge profiles, they're not really

comparable. Uh,

you know, one uh experiment my my

brother Aaron did, he he also trades on

Koshi. He simulated okay if compared to

a Monte Carlo simulation of whenever I

paid uh 60%

let's do a simulation where that event

happened 60% of the time and plot

uh that distribution say 10,000 take all

my bets run each of them through saying

I I got a fair look at my actual P&L and

plot it versus

where it would come out on this

distribution. It gives you some idea.

I mean, right now, my P&L is positive.

Uh, but I haven't really lost any big uh

like bonding trades or like the ones

where you pay 90%. So, if I just lose a

few of those, you're going to have a

huge gap down. So, I don't have enough

sample to to guarantee that I'm making

money. Um,

but having a reason why each trade has

edge,

I think, is more important in the in the

short run. At least having a a

reasonable hypothesis.

Yeah. Statistically, it's hard,

especially as the market changes. If

you're betting on all kinds of different

things, it's hard.

I I want to gear our conversation more

towards, I guess, what you're trying to

build with your brother with Kraamic.

Um, and I know it's a it's an analytics

tool. What are you trying to do?

>> So,

my brother Aaron and I I have two

brothers, by the way. One of them is a

trader at Suspana. Uh, and Aaron is my

other brother who's an actuary.

So,

Koshi and Poly Market are both valued at

over $10 billion, growing very quickly.

My theory is that there's going to be a

whole lot of other businesses that fill

in all kinds of gaps around news sources

or different user interfaces. You know,

the user interfaces on these sites is

not

um I think it's a more like retail

focused uh user interface. So, my guess

would be that the

elite the elite traders of the of the of

the world are building their own custom

user interfaces.

um targeted towards how they want to

trade or the data they want to look at.

And so the couchomics was just uh one

project that uh my brother and I did

that created a different um way to

uh discover markets, look at the data,

look at the volume, uh the open

interest, what's going on today. Um was

not meant to be the Bloomberg terminal

of friction markets, which is what every

other project claims. This was meant to

be like let's build something that uh is

small but useful.

And so I'm I'm out there looking at uh

various projects and I think the

ecosystem is going to grow and and

talking to various teams. Uh just a it's

a rapidly changing rapidly growing

environment and there's just a lot of

interesting room for growth. Um, one

really unusual state of affairs in

Christian markets is

in say liquid stocks, you're not going

to be able to vibe code your way to a

market making system. It's just never

it's never going to happen.

I think if you're a competent programmer

who also has some trading knowledge,

there's probably some amount of of money

you could make by building something

that trades on on Koshi, for example.

And I know there are teams of one or two

people that have a bunch of laptops and

are are trading um maybe making a mount

that's a lot for them, but would be very

small for institutional trading firm.

And I don't think these opportunities

come up very often. I think it's a it's

a short window where there's not as many

institutions in these markets. If they

keep growing, I think the professionals

will crowd that activity out. It's kind

of a rare time when talk about new

markets and, you know, people that were

trading options in their dorm room 30

years ago or something. Uh I think this

is one of those times where smart

amateurs

can have an edge which is just unusual

and it's you're not going to do it in

market making Apple stock but there is

some opportunity here. That said if the

cost of trading prediction markets are

high and it's hard to build these

systems too. So I'm not recommending

everybody who can grab a flaw code and

start trading on like you need you need

to be to to work hard but it's a much

lower barrier to entry than

a you know quantitative system in uh say

a trady a high liquid equity market

do you think the volume will grow to the

point where the

called top trading firms dedicate

significant resources ources to

to them because I know they're already

doing some you know like I know soana is

um but you know do you think they'll

grow to the point where it will become a

significant revenue generator for these

top trading firms? Um

maybe

sports is obviously big and there's

still some legal uncertainty and a lot

of lawsuits going on right now but that

is a huge market.

Um,

I think elections will continue to be a

huge market and an important one, right?

And and it's also the best so the the

the best markets for prediction markets

are things that are naturally binary

outcomes

that it makes sense as a binary outcome.

So an election,

did this person win? That's a great fit

for prediction market. Some of these

other other markets are not as

unique, I guess. So there's markets on,

you know, will the S&P 500 finish above

7100 this week? You can just trade the

S&P 500. You can just trade a a call

spread on the S&P 500 options. Uh

prediction market's not really giving

the cleanest best way to to take that

risk.

on election though it is there's a lot

of people trying to get election

exposure through making bets on the

index or on sectors and and stocks and

that's one of the things that TK talked

about on like why they started cali

um but you don't know exactly where

those are going to go in after an

election you might know that Trump is

good or bad for the sector or whatever

but you don't know where they're going

to go

so prediction markets give a really

clean way of making that bet that's the

like the

use cases. They're a natural fit. And

these other things are they're okay. Um

there's there's some things that I've

written I I don't think should be

prediction markets. I don't think we

should bet on everything. I think the

mention markets are while interesting to

model, they're kind of dumb. people can

manipulate them and have for fun and

you'd never even be able to tell if

somebody was, you know, insider trading

on them or doing a speech, a speech

writer betting, for example. So, I don't

think those are those are great markets

even even though they're interesting.

And then there's just been a couple of,

you know, dumb markets out there, right?

Poly market, I have a few I'm not going

to mention. Um, but I I think some

restraint in terms of what should we bet

on and structuring good contracts is

important for the legitimacy of the

space. you know, talking about the

legitimacy of the space and on insider

trading. Um,

I'm not sure where I read this, but

um, someone was arguing that insider

trading is essential for prediction

markets because that's the only way you

get high quality information. So

something along the lines of, I don't

know, is the US military going to do

certain activity in some country, right?

If you have a, you know, someone who

works in the military who's involved in

this, a whale, and he puts on a huge

position, that's information that's

valuable to everyone else where they can

assess. I guess it's closer to the

actual probability um of of of things

happening. Got to get your thoughts on

that.

I've seen this debate about is this

trading good or bad for prices.

I think it's kind of ridiculous that

we're having this debate. I I I don't

think as a side trading is good for for

markets. Um

in the short term, sure, you you might

get the probability of uh Venezuela uh

attack a few hours earlier or whatever

if somebody trades on it, but in the

long run, it's going to damage liquidity

in markets. If you have huge amounts of

adverse selection, liquidity is going to

go down. And so that might might make

these markets less efficient over the

long term or the longer term. Um creates

terrible incentives

around

people having access to information.

So well a if if you're in the military

and you're you're trading on a strike

and announcing to the world that like if

if you're a senior leader, you do not

want your people to do that. Like that

that's that's terrible for for security,

right? So there's a huge incentive not

to do that. Uh you don't want people

doing that. I think that's pretty

obvious.

Imagine

so there was a market on the Google most

search person this year and you would

imagine that somebody at Google's going

to have that information first.

There's been some discussion debate

around you know was did somebody with

access to that information and start

trade on it. I think it's often harder

to say

adver just adverse selection or someone

doing really smart research versus an

insider. There have been cases where

everyone has screamed insider trading

that have actually been someone doing

something really clever or even the

information leaking a certain way. So

just because the market gaps early, you

don't know why can't call insider

trading. But let's just say that insider

trading is fine and everyone's allowed

to do it on these markets and we say

there's no rules, right? It's all

anonymous. There's no

um any kind of investigation. Can you

imagine the Google employees all

fighting to be the first one insider or

trade that market?

Imagine everyone on the team being like,

you know, this year is my turn. I get to

trade it on Kali, guys. And then the

boss being like, you know what, you got

it last year. Um you know, Samantha,

we're we're going to let Jimmy Insider

trade this year. or um part of your

bonus package. Say, you know, hey,

instead of stock options this year, why

don't why don't we give you 24 hours to

insider trade on the most searched

person on Kouchi this year? How about

that instead of would you like that

instead of your stock options?

And then they come back, well, could I

get 36 hours to insider trade boss deal?

Like this is so bad for incentives

around access to information and

trusting people with information. Uh I

think I think it's socially corrosive in

that way and to talk about it as if it's

accepted and and that this is a natural

part of markets I just I think is

shortsighted.

>> Would you say that overall prediction

markets are a net good or a net bad for

society?

>> I think they can be useful and and right

now there's a lot of takes uh far on one

side or the other. The thing that I

think is good is

providing

a marketbased uh probability to

news that's of use to the general

public. So probability of people winning

elections um even some like the measles

cases probabilities

to geopolitical events I think are

useful. And I do this when I read a

headline that sounds scary sounds

escatory in the Middle East or Green

whatever I'll check the prediction

market. So like okay is this new

information or not? And it helps me get

a better feel for

maybe not the truth. I don't treat these

markets as a truth. I treat them as one

signal and especially less liquid

markets. It's it's not a truth machine.

It's just a limit order book that maybe

tends to to predict the future uh better

than a pundit would otherwise. But it's

a it's a step in that direction. And I

think in general as a society, we don't

view things probabilistically enough. So

if we can incorporate more uh

well-calibrated probability

discussions to society, I think that's

great. On the other hand, if everybody

just becomes a degenerate gambler on,

you know, 15-minute crypto markets or

starts betting huge amounts on sports,

uh, that otherwise wouldn't, I don't

think that's useful.

>> When I think about this, I think that

overall they are a net bad. Um, and this

is obviously just from my experience as

a as a college student. I don't think

that the average participant participant

is a nuanced thinker about these things

and thinks about them as a as you would

as a as a as anformational, you know, as

a as a signal for for information that

they can incorporate as part of their

view on um the chance of certain events

happening and then using that

information to make better decisions, I

guess, for business or for work. Um

because I I do think that there is a

tendency to gamble today especially and

I think there was that article going

around on X I think it was a month ago

or a month and a half ago about it was

called the prison of financial

mediocrity. I'm not sure if you read it.

>> Um

>> I think I did. Yeah. It's

and

I found that article to encapsulate what

young people are thinking, what

um what what what people with with with

less opportunity are thinking. um just

just bet it all because I I guess to

escape the permanent underclass, but um

to to escape what he calls a prison of

financial mediocrity. And and I think

that so often that's the mindset today.

Um, and I don't think that having

prediction markets,

you know, having access to prediction

markets within your Robin Hood account,

for example, where you can get on bet on

sports, you know, that doesn't strike me

as something that's good for society.

And I guess my question to you is how do

you think these things can be

implemented

in a way where we minimize say

degeneracy and maximize the signal and

the quality of information and really

just using them as a tool for forming

one's view of the world.

So right now there's a lot of I think

wellfounded concern about the

casinoification of America especially

among young people of all these

opportunities to gamble whether that's

sports betting

speculation and in stocks or options um

i gaming that's like the casino on your

phone which I think is especially

dangerous towards those in um

predisposed to problem gambling

And you can certainly use prediction

markets as a gambling tool.

The is a quick way to lose money if

you're trading randomly.

So I think when these companies

advertise prediction markets,

advertising it appropriately

and not as a quick way to make money is

important.

uh I think they can serve a useful

purpose in some cases of providing

context to news

and at a they don't need to be gigantic

markets to be somewhat efficient and so

the benefit applies to everyone who can

get this good context

and

the cost I think is relatively low

compared to some of these other outlets.

The other thing I like that I'm hopeful

that happens as prediction markets grow

is actual risk transfer. And so this is

talked about a lot as a good use case

for prediction markets, but people who

have risk to some factor providing a

venue to quickly spin up a contract and

trade it. So insurance type markets are

a good example of that. If you live in

Florida, having a contract where you

could hedge some of your insurance risk,

and I lived in Pennsylvania, I would

love to be short some Florida hurricane

risk, short some uh California

earthquake risk risk. If I can add that

to my portfolio, that's probably going

to increase the performance

characteristics of my portfolio at the

same time providing a lowcost way uh to

provide insurance. So when when boosters

of prediction markets talk about

prediction markets, they they talk a lot

about this risk transfer idea. How much

of the volume is actually risk transfer

right now? Uh it's it's probably very

low, but that's what I'd like to see

volume grow in um rather than some of

these other categories I think are less

useful. There's also a certain amount

of, you know, who am I to say what's

useful? Um but you know I have an

opinion that's to the extent that my

opinion carries any weight. I want to I

want to promote uh good use cases and

and responsible trading and not um you

know just gambling.

>> Absolutely. Um final question. We've

talked a lot in this conversation and we

started off talking about your

background at at Ciscoana

um about the nature of edge in

prediction markets. Um, and then you

know now like walk us you walked us

through an example then now just um

whether or not you think they're good

for society. Um, and I think your

vantage point having

worked for many many years as a as a

very I mean as a trader at at Suscuana,

a senior trader later on. Um,

you have a very unique vantage point on

the way you make decisions and it I find

it funny how

doing an EV calculation is second nature

to you and I imagine second nature to

many other people who worked in the

industry as quant traders at the at the

big shops. What's one lesson that you've

taken from all this that you think can

apply to anyone's life? Um,

and will lead to I guess better expected

outcomes.

One thing

say just the the very basics of framing

this decision this way. Not everyone

needs to study a ton of probability and

not everyone needs to get fine-tuned

super optimized estimates. Just trying

to run through for a decision. What are

the risks? What's the probability?

What's the upside of this? And am I am I

in a position to take risk? Um just

practice framing a few decisions that

way. You don't have to overdo it. Like

do an expected value calculation for who

you marry. Don't do that. Um but doing a

little bit more um

you know small examples might be should

you pay for uh

trip insurance right these those types

of insurance bets are usually really

negative expected value

um for an example I don't have collision

insurance on my car because if I crash

the car I'm just going to buy a new car

and so I want to pay this consistent

like the insurance company knows the

probability of me crashing way more than

I do and they're pricing it in a way

that that decision has um negative

value. Now I'm increasing my variance

quite a bit by not having that right but

I can afford that variance in my

portfolio and I've thought about it.

insurance makes a ton of sense if you

don't want that variance. But if you

haven't thought about it, society just

tells you, okay, oh yeah, you know, buy

that insurance. And so when you don't

think about things through risk

framework, you can a take risks that you

didn't know you were taking and b give

up uh expected value in your life um in

ways that you're not aware of.

>> I love that. Thank you so much, Andrew,

for coming on Odds on Open. All the

best.

Thanks, Ethan. Great chat. See you.

Interactive Summary

Ask follow-up questions or revisit key timestamps.

Andrew, a former senior quant trader and market maker, discusses the demanding nature of his past career, highlighting the constant monitoring, lack of breaks, and mental intensity required. He explains the cultural shift from floor to electronic trading and how his firm utilized poker as a unique training tool to cultivate probabilistic thinking and decision-making under uncertainty. Later, he explores prediction markets, identifying sources of "edge" in less efficient categories, critically analyzing the societal implications of insider trading, and offering perspectives on how these markets can be a net good through responsible advertising and risk transfer, rather than encouraging degenerate gambling. He concludes by advocating for the application of "thinking in bets" to everyday life decisions.

Suggested questions

8 ready-made promptsRecently Distilled

Videos recently processed by our community