NVIDIA's Biggest Customers Just Lost $1 Trillion in One Week

Now Playing

NVIDIA's Biggest Customers Just Lost $1 Trillion in One Week

Transcript

281 segments

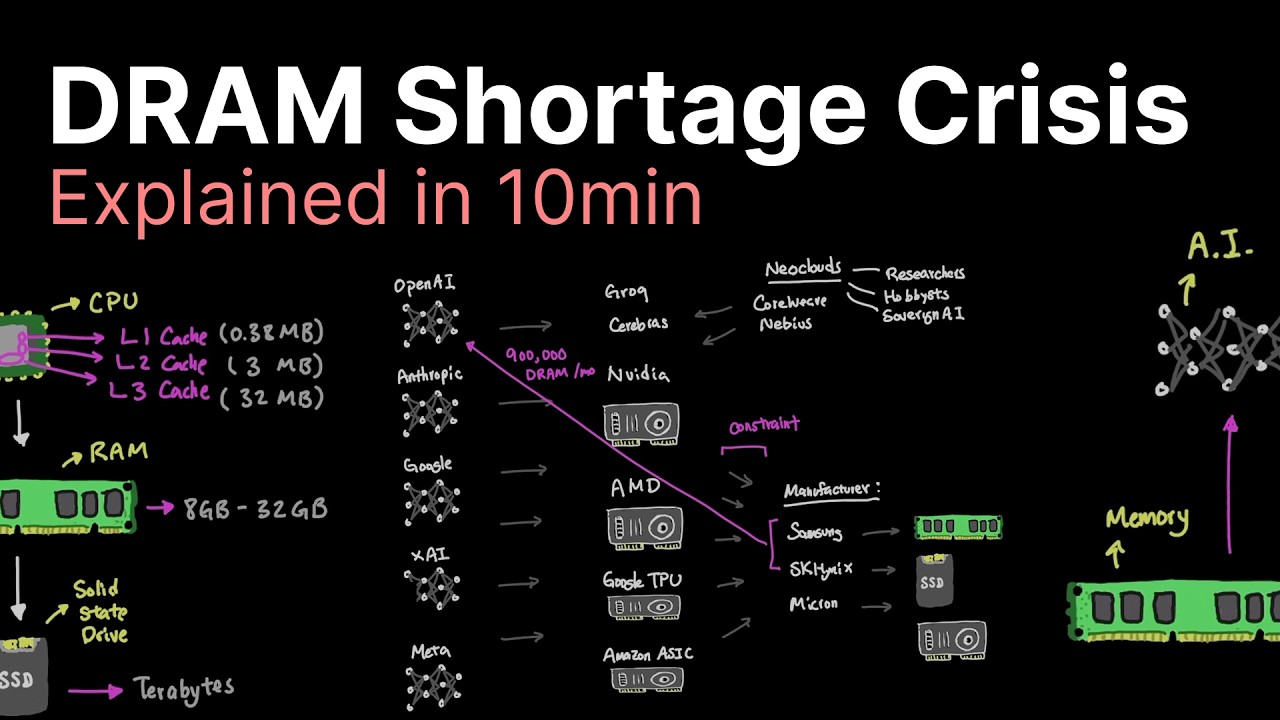

$1 trillion in market cap gone.

That's how much Nvidia's four biggest

investors lost over the past week. Not

because their products failed, not

because of a recession, but these four

companies each announced how much money

they were planning to light on fire in

this insane crusade for more AI

infrastructure and AI chips. Wall Street

saw that in the earnings report and they

said, "Doesn't sound like a good play to

us." Let's break it down. Over the past

two weeks, these four companies

announced that they'd be spending about

690 billion in capex in 2026 for AI

infrastructure and chips. Let me say

that number again. 690 billion spend in

2026 for AI chips in one year. And if

you've lost track where almost $700

billion is going, let's break down a

highle overview for you here. So

Microsoft announced that they're going

to be spending 120 billion or more in

fiscal 2026 on AI infrastructure. They

dropped $ 37.5 billion in just a single

quarter as per their last earnings. And

they still have an $80 billion backlog

of unfulfilled Azure orders because they

don't have enough money to turn the

power on. Alphabet doubled down. I just

did a video on that a couple of days

ago. They're announcing guidance for

$180 billion in spend this year. And

when I say double down, I mean that

quite literally. That's about double

what they spent on AI infrastructure

last year. So this is quite unusual. It

is like they are preparing for a war,

not a product launch. Amazon wins the

trophy, though. $200 billion in spend

announced this is robotics, AI,

infrastructure, data centers, even

satellites. That's 50% year-over-year

growth from what they spent last year

and 200 billion. I mean, it's the it's

larger than the GDP of a lot of

countries. Meta announces between 115

and 135 billion. They're building a one

gigawatt factory in Ohio somewhere. I

don't even know what a gigawatt is.

That's like back to the future numbers.

Zuck is calling it Meta Super

Intelligence Labs. We'll throw a fifth

one on there uh just as an addin. It's

kind of like your your baker's dozen.

You get an extra in the bag. Oracle

chipping in 50 billion, you know, chump

change. So that's around 700 billion

from all of these companies, which

again, this is like an imaginary amount

of money. Like I have no idea like if

you had $700 billion in $100 bills, like

how much space would that even take up?

It's an incomprehensible amount of

money. So you think you're thinking like

maybe this is just pretty typical uh

capex spend for a business of this size

involved in the AI war. And it's not. If

we add them all up and then compare what

they all did last year, it's about

double. When you come out with your

earnings report for the quarter or for

an entire fiscal year like these last

two weeks entailed for those companies,

it's a direct report on how the business

is doing. But of course, you're going to

try to skew those numbers a little bit

because essentially what you're doing is

you're trying to portray, you know,

confidence and like this is a good

investment for the big whales on Wall

Street to invest in your company or if

they're already invested to not yank

their money out of your company. When

these earnings came out for each of the

companies, their valuation, their stock

price dipped. People sold. Wall Street

was not thrilled. And it's not like over

the next couple of days. I mean like

immediately as soon as earnings end, you

see like a big sell-off and dip of these

stocks. To get you some specifics about

that, Alphabet dropped about 9% after

the announcement. We covered that here

on the channel just a few hours later.

And there's been some noise, but they

haven't recovered. They're still down

about 21% from their recent high. I'd be

calling that bare market territory for a

$2 trillion company. Microsoft down

about 25% from its recent high. We

covered that on the channel right after

it happened. Azure Growth missed

expectations on Jan 29th and the stock

has been in basically a freef fall since

then. And quick shout, if you're missing

these videos and you're not subscribed,

let let's fix that. Just click the

subscribe button right now. You'll be

notified when these videos and earnings

reports come out. Meta is about 2 to 3%

away from bearer territory. They're

really skirting the line there. And

that's a crazy one because they actually

beat earnings, right? But there was

still a decrease in their stock price

because the amount that they said they

were going to set on fire for AI

development scared people. Now, Alphabet

fared the best out of these. They're

only down about 9% and my hypothesis is

that is because they are not paying the

Nvidia tax. They are not in a lifetime

of slavery with Nvidia. They are making

a lot of their own chips as you know. So

their TPUs, their own proprietary chips

have given them a little bit of

insulation from the Nvidia black hole

that's pulling all of these companies

in. Again, combined that's about a

trillion dollar in market cap

evaporating. Remember that's not because

they announced, hey, we missed our

earnings and it was bad. They beat

earnings. There was a good prognosis.

This is because they said, "We're going

to spend an insane amount of money on AI

infrastructure. We're taking a huge bet

on this. All chips on red." And the

market is saying, "Where is my money? I

want to be paid. And I don't believe

that this AI gambit is going to pay off

for you." Jensen is laughing all the way

to the bank, though. A huge chunk of

every dollar lost for all of these

companies is flowing straight into

Nvidia's pockets. They posted 57 billion

in revenue in a single quarter. Their

data center division alone did like 50

billion. And that growth is nutty. I've

never seen anything like it other than

in a very small startup where the

economics worked out. They're up 66%

year-over-year and 25% quarter

over-arter. They're guiding 65 billion

for Q4, which they're going to report on

February 25. We'll have the analysis and

coverage of that on this channel. Full

fiscal year consensus for 2026. Make

sure I'm getting this number right.

213.3 billion in revenue. That is crazy.

At the end of the day, it doesn't matter

to Nvidia. It doesn't matter to Jensen

if any of these AI companies ever make a

dime. He sells chips. They sell GPUs.

They sell compute infrastructure. As

long as people keep buying their compute

infrastructure, it keeps the business

going. It keeps the business profitable.

If I sell arteasonal coffee mugs and I'm

selling you this coffee mug for this is

$5,000, right? And you're missing rent,

you're earning minimum wage, you can't

you don't have $5,000. So, you get it on

CLA or whatever the hell people are

using for a buy now pay later thing and

you split the payments up. That's going

to cause you a lot of hardship to make

those payments. But at the end of the

day, I I don't care. As long as you're

solvent and you pay me, I get the money.

Your financial situation doesn't matter

to me. That's exactly the situation that

Nvidia is in is OpenAI anthropic. How

are they going to profit from these? Are

they going to do ads? Are they not going

to do ads? That's important stuff. But

to Nvidia doesn't matter because they're

going to keep buying chips. That's the

only thing that matters. They sell

chips. They're in the chip sales

business. They're not in the AI business

and stock is doing good. So, let that

sit in your head that the market

actually thinks that Nvidia is doing

well and that this is sustainable. I

guess we'll find out if there's a big

upset after those Feb 25 earnings, but

right now it seems like smooth sailing

for Nvidia. And you might say, Dr. J,

but wait, I'm worried. I'm worried for

Sam Alman, the humble, noble, visionary

tech leader who's never had a real job

in his life and is not a software

engineer. What about him, Dr. J? And I

got good news. I mean, Sam Sammy boy is

going to be making a little money off of

this as well. And after some brutal

difficult math was able to come up with

a figure of about four cents of revenue

on every dollar spent on AI. That's

about how much profit is actually being

generated. It's four four cents on the

dollar. Okay. Even dinosaur

organizations like Fidelity are finally

starting to catch on to, hey, this might

be a bubble. We may have gotten ahead of

ourselves a little bit here. So, let's

take their five indicators of, hey, this

is a bubble, and see if they apply to

everything we've just said in this

video. Elevated valuations, check. Rapid

spending increases, check. Remember,

that's double growth and AI capex this

year. Circular financing. Open AAI uses

Nvidia chips. Nvidia gives OpenAI money,

but it's not money. It's money to buy

the chips. Check. Debt reliance, check.

If you saw my video on SoftBank the

other day, it looks like they're going

to be leading the next funding round for

OpenAI. Check. In lagging monetization,

check. They don't even know by their own

admission in the Super Bowl commercials

how the hell they're going to make money

off of this. So, that's five for five.

And that's Fidelity talking, not some

random bearded YouTuber. I mean, that's

circular funding. It It sounds like a

fun merrygoround to be on. I wish I was

on it. I'm not on a fun carnival ride

right now, but to be on that

merrygoround, you know, they're tossing

money at you. They got Mr. Alman over

here. You know, you're a celebrity. You

got tons of money. If this thing goes

belly up, you're you're going to be

fine. You're going to be fine. You got

plenty of money. You were on the

merrygoround. The trick is hopping off

before the music stops. And when is that

going to happen? I don't know. That's

the million-dollar question. If I could

answer that, I probably wouldn't be

making YouTube videos. I'd probably be

retired on some island somewhere. But

nobody knows. Uh, all I know is that the

fundamentals are off. The market has

become emotional and speculative. It

meets all criteria of any bubble that's

ever happened. And it's not a matter of

if the collapse is going to happen

around this. It's a matter of when.

Michael Green of Simplify said it best.

Quote, "Artational market would price

these risks." Unfortunately, we're not

in a rational market. Again, we're going

to be hitting a full analysis of

Nvidia's Feb 25 earnings. That should be

the best information we've gotten on

this in terms of raw numbers in quite a

while. So, I'm really stoked for that

coverage. I hope you're here for it. And

if you haven't signed up already, sign

up for the newsletter. You'll get my

free AI spending tracker that's released

quarterly. It has all of the numbers and

metrics about what we're talking about

in here in paper so you can sit down and

form your own conclusions. Thank you so

much for watching.

Interactive Summary

Ask follow-up questions or revisit key timestamps.

Four major tech investors of Nvidia recently lost $1 trillion in market cap, not due to product failure or recession, but because they announced colossal spending on AI infrastructure and chips. These companies plan to invest around $690 billion in capex for AI in 2026, with Microsoft earmarking $120 billion+, Alphabet $180 billion (double last year), Amazon $200 billion (50% YoY growth), and Meta $115-135 billion. Wall Street reacted negatively, causing significant stock dips for these companies, despite some beating earnings, indicating skepticism about the return on investment for this 'AI gambit'. Conversely, Nvidia is thriving, posting $57 billion in revenue in a single quarter, as its business model relies on selling chips and compute infrastructure, independent of its customers' eventual AI monetization. Concerns are mounting about an AI bubble, with Fidelity's five indicators—elevated valuations, rapid spending increases, circular financing, debt reliance, and lagging monetization—all present in the current AI market. The speaker concludes that the market is emotional and speculative, fulfilling all bubble criteria, suggesting a collapse is a matter of 'when', not 'if'.

Suggested questions

6 ready-made promptsRecently Distilled

Videos recently processed by our community